It is a recognized truth that the world economics is going through a rocky road nowadays. And due to the fact that of that, more people are finally being awakened to the reality that quicker or later, they 'd need to begin getting retirement preparation suggestions.

Females retirement planning is going to be the very same as anyone else. You should look for aid from a monetary planner so that you are ready and able to retire when the time comes. These companies will assist you determine what you are going to need to have for retirement and how to invest the cash appropriately so that you are safe and secure. You will wish to think of looking at a retirement planning guide so that you are able to get prepared on your own and have the best knowledge for everything that you will have to have so that you can retire in convenience.

However, it can be a little bit more complicated than that. It is mainly important for young specialists right out of college to start conserving and prevent a significant wake-up call later on in their careers. Below are 6 steps to take right now to begin preparing for monetary security and retirement.

For employers with employees who work less than 20 hours each week, there are routine 401K options - ask a payroll company or consultant for more details on these plans.

Financial preparation is a must to accomplish this objective. You need the help of monetary planning software to make it simple so you do not have to determine it yourself. It is created to make complete and in-depth monetary plans of a private over his life span. What is fantastic is that it can deliver in simply minutes.

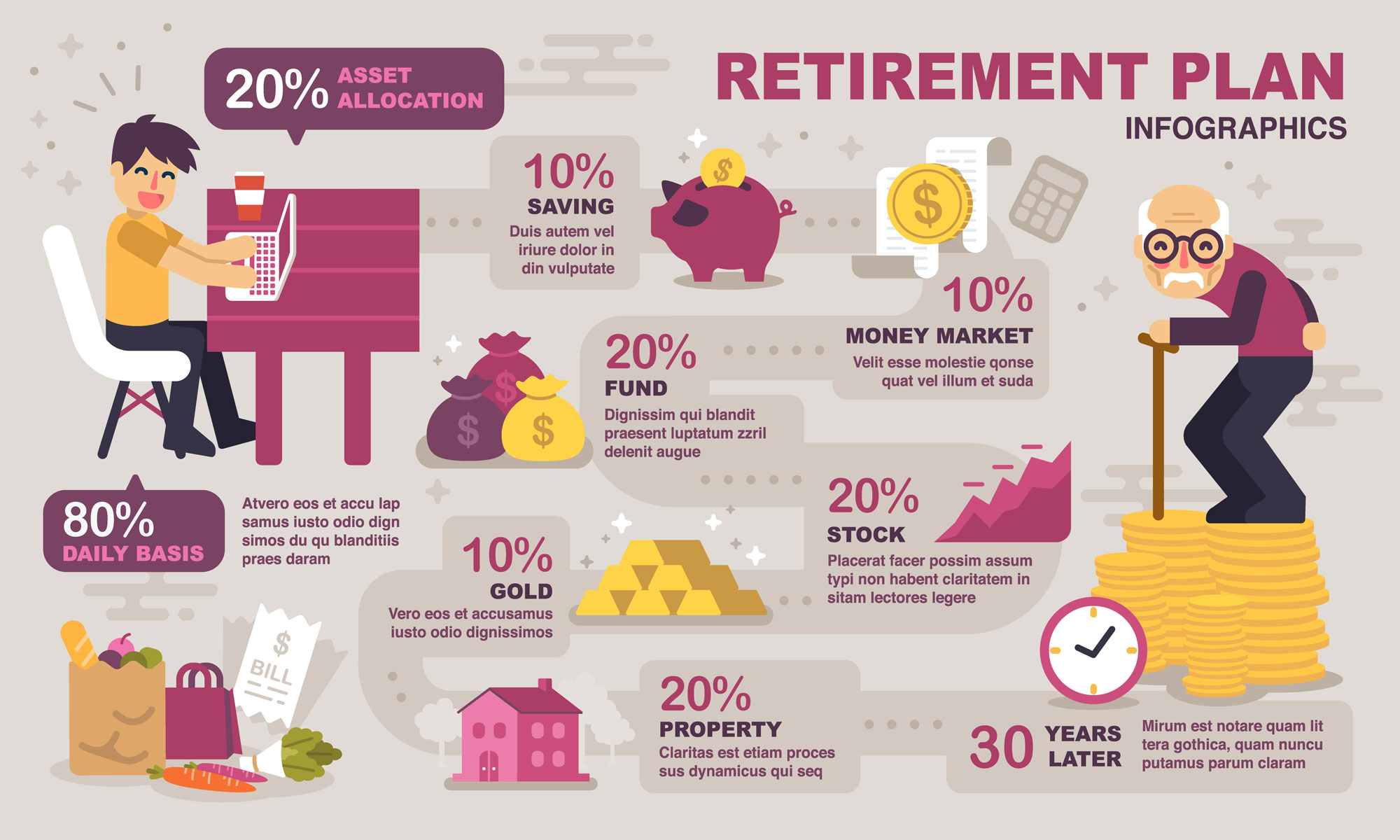

Action # 5: retirement planning Assemble all your assets. Possessions you'll want to list here include your home, investment properties, retirement investments (401k, IRA, etc), annuities, pensions, stocks & bonds, antiques (paintings, coins, comics, and so on), savings (money, CDs, Treasury Expenses, etc) and other prized possessions.

The very first thing is to utilize excellent judgments if you are not sure about how to tackle making the correct options then talk to an expert. Do not choose on your own if you are uncertain. This is a do refrain from doing and can lead to no retirement fund.

By following these 6 actions, it is possible for those under 30 to get a realistic idea of how to conserve for retirement. You will want to be prepared for one of the most essential times in your life, and you can do this by conserving for retirement now.

Comments on “Retirement Preparation - The 5 Most Typical Mistakes”